Powering Businesses Through Affordable IT Systems

LOAN MANAGEMENT

Our loan management solution – suitable for financial service providers like micro-financing institutions, savings and credit cooperatives, government lending agencies – features the following central functionalities:

Loan Origination and Scoring: Specifically developed to support the loan application processing needs (both retail and corporate needs), besides automating the business process involved in managing Loan Processing, it also improves the sales and customer satisfaction. It employs workflow technology to control and monitor the various work steps in the loan processing and uses digital imaging technology to reduce the delays and inefficiencies in handling paper documents.

Loan Administration and Collection: This is a web-based delinquent accounts allocation and tracking functionality that automates the collection cycle by integrating both internal and external collection agencies.

The rule engine does parameterized segregation of customers, ensures risk-based allocation of cases, and streamlines tracking and follow-up of customers with loan repayment dues. It allows for multi-level follow-ups like awareness calling, reminders by way of mobile messaging, email and ordinary mail. To facilitate better recovery, the system also includes advanced features such as auto generation of the legal notices based on number of days past due date as well as Repossession and Auction Management.

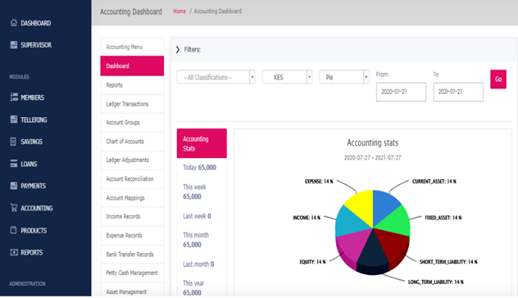

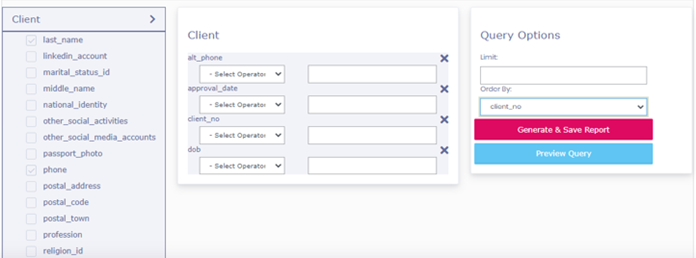

Business Intelligence and Reporting: This is a centralized web-based data warehousing solution providing standard reporting around management of business and operations. It also allows for customization based on customer needs. It can also be integrated with other data analytics tools to complement organization insights.

Audit Compliance: Automates the audit and compliance processes to help organizations setup the entire audit cycle rolling on the wheels. With a single click of a button an organization can get a glimpse of all the compliances and non-compliances at the central, regional and municipal level

Please contact us to discuss your business needs and arrange for a demo.